Longevity

Last Updated

Jan 2, 2026

Finding the Best Age to Retire for Longevity

When it comes to the best age to retire for longevity, the research doesn't point to one magic number. From my professional experience and personal exploration of health data, there seems to be a sweet spot, a window of time that often lands around age 65 or a little later. This timing appears to strike the right balance between staying active and engaged versus the risks of burnout and chronic stress from a demanding career.

Ultimately, the perfect age is less about a universal date and more about when retirement aligns with your personal health, your financial reality, and your sense of purpose.

The Real Connection Between Retirement and Longevity

Deciding when to hang up your work hat is one of the biggest calls you'll ever make, impacting everything from your bank account to your very sense of self. For years, I thought of retirement as a finish line you cross once your savings hit a certain number. That perspective shifted when I watched relatives, who had worked their whole lives, suddenly feel adrift and purposeless after they stopped. It made me realize the question was much deeper: how does this massive life shift affect our health, not just our wealth?

This conversation has taken on a new urgency as we’re all living longer than ever before. It's a worldwide trend. Between 1950 and 2019, the average global life expectancy shot up from 48 to 73 years. That incredible leap means we have to completely rethink what a long, healthy life can and should look like. You can explore more about these global retirement trends and their implications.

Beyond Lifespan to Healthspan

The real goal isn't just to add more years to your life, but to add more life to your years. We're talking about extending your healthspan—that period of life where you feel good, are free from debilitating chronic disease, and can do the things you love. This is where the health information surrounding retirement timing really comes into play.

A career can be a powerful force for well-being, offering mental puzzles to solve and social circles to belong to. But it's a double-edged sword. A high-stress, physically grueling job can wear you down, accelerating the aging process. On the flip side, a retirement that lacks engagement can lead to a surprisingly quick decline in both body and mind.

Finding Your Personal Retirement Window

Instead of a generic answer, this guide will dig into the real science connecting when you retire with how well you live. We'll look at health data, break down the personal factors that matter most, and offer practical ways to design a retirement that feels both fulfilling and built to last.

To get started, it's helpful to think about a few key areas:

Financial Health: Are your finances ready to cover not just everyday bills but also the inevitable rise in healthcare costs over a potentially long life?

Physical and Mental Wellbeing: How is your health right now? Does it support the kind of retirement you envision for yourself?

Purposeful Engagement: What will you do to replace the structure, identity, and social life that your job provided?

Working through these questions is the first step toward finding the best age to retire for your longevity. It helps you turn a simple date into a thoughtful, personalized strategy for a healthier future.

What the Research Says About Retirement and Health

When I first started digging into the connection between retirement and health, the headlines all seemed to scream the same thing: "Work longer, live longer." But the more I looked into the actual studies, the more I realized that simple answer was hiding a much more interesting, and complicated, truth.

The relationship between your retirement date and your healthspan is anything but a straight line.

Many articles point to a correlation suggesting that people who retire later also tend to live longer. The problem is, this often ignores a massive statistical elephant in the room: the healthy worker effect. This is the simple idea that people who are able to keep working into their late 60s or 70s are often just healthier to begin with. Their longevity might have far more to do with their pre-existing health than the act of working longer itself.

The Problem with Simple Conclusions

Think of it this way. If you notice that people who regularly hike steep mountain trails live longer, you might conclude that hiking is the secret to a long life. But it's far more likely that only people who are already in great shape can even attempt those trails in the first place. Their underlying health is what allows for the hiking.

This is the exact same dynamic we see in so much of the retirement research. An individual with a chronic illness might be forced to retire early. Meanwhile, their healthier colleague can easily keep working for years. Just comparing their health outcomes without accounting for their starting points would be completely misleading.

Adjusting for Health and Background

The best health information comes from studies that work hard to correct for this bias. They meticulously adjust their data to compare apples to apples, looking at people with similar health profiles and socioeconomic backgrounds. When you make those adjustments, the findings get a lot more nuanced.

For example, a major review of multiple studies found a fascinating pattern. On the surface, retiring "on time" (around the standard age) seemed linked to a higher mortality risk than working longer. But as soon as the researchers filtered out the noise—by adjusting for prior health and other demographic factors—that connection completely vanished. This strongly suggests the "healthy worker effect" was skewing the initial results. You can see for yourself how context changes these mortality associations in the full research paper.

The takeaway? We can't just take these broad statements at face value. An individual's health journey before retirement is a massive predictor of their health after it.

What the Data Really Tells Us

So, if working longer isn't some magic bullet for a long life, what actually matters? The research consistently points to a few key themes that are far more important than the specific date you hand in your notice.

The Nature of Your Work: Is your job a source of fulfillment and gentle engagement, or is it a high-stress environment that's actively grinding you down? A stressful job can raise inflammation and cortisol, directly harming your long-term health.

Voluntary vs. Forced Retirement: The reason you retire matters immensely. Someone who enthusiastically chooses to retire to pursue a passion project will likely have a very different health outcome than someone pushed out by a health crisis. That sense of control is a powerful health tonic.

Social and Physical Engagement: For many, work provides a built-in social network and a reason to get up and move. The people who thrive in retirement are those who proactively replace these benefits through hobbies, volunteering, and a solid exercise routine.

Ultimately, the science is telling us to stop obsessing over a single number on the calendar. The best age to retire for longevity is deeply personal. It's about finding that sweet spot where you can preserve the good parts of work, like purpose, while shedding the parts that damage your health, like chronic stress.

How Retirement Timing Impacts Your Mind and Body

So, why does the date you circle on the calendar for retirement have such a massive impact on your health? It’s not just about finally escaping a demanding job. The real story is about what you trade in the process. I’ve seen it firsthand: a poorly planned retirement can leave a person feeling adrift, while a thoughtful one can kick off the most vibrant chapter of their life.

That shift from a life structured around a career to a wide-open schedule is a delicate dance. It’s far more than a financial calculation; it’s about actively managing your mental, social, and physical health in a completely new context.

The Use It or Lose It Principle for Your Brain

One of the most common fears I hear about retirement is the worry about mental decline. For decades, your career likely gave your brain a daily workout—solving problems, learning new software, and managing complex projects. All that constant engagement builds up what we call cognitive reserves.

When that daily mental gymnastics suddenly stops, your brain can feel the loss. It's the classic "use it or lose it" principle in action. A retirement spent without new challenges can accelerate a decline in memory and decision-making. But the answer isn’t to work forever. It's about finding new ways to keep your mind firing on all cylinders.

The Power of Routine and Purpose

Your career provides two crucial psychological anchors that often go unnoticed until they're gone: structure and purpose. Your work schedule sets your alarm clock, dictates when you eat, and keeps you physically active. For many of us, our job is a core part of our identity.

Losing that framework overnight can be incredibly disorienting. It can wreck your sleep, lead to a far more sedentary lifestyle, and create a nagging sense of aimlessness. This is a critical piece of the puzzle when we talk about the best age to retire for longevity, since both sleep and activity are pillars of long-term health. If you're looking for a solid foundation, our guide on how to improve sleep quality naturally offers practical, health-focused strategies.

The people who thrive in retirement are those who intentionally build a new framework. This often involves:

Crafting a new daily schedule: Setting regular times to wake up, exercise, and connect with others.

Finding a new "why": This could be anything from mentoring young professionals to volunteering for a cause you care about.

Setting meaningful goals: Planning a big trip or starting a project that gives you a tangible sense of accomplishment.

The Balancing Act of Stress and Social Connection

Finally, let's talk about two powerful, opposing forces: stress and social connection. A high-stress job can be a silent killer, contributing to chronic inflammation and high blood pressure. Leaving that toxic environment is often one of the biggest health wins of retirement.

But here's the catch: work is also the primary source of social interaction for most adults. Retiring abruptly can sever those daily connections, paving the way for social isolation and loneliness—two factors heavily linked to poor health and shorter lives.

The real challenge is to escape the chronic stress of your job while holding onto the social benefits. That's the ultimate balancing act for a long and healthy retirement.

How the World Views the Ideal Retirement Age

The idea of hitting a specific age—say, 65—and abruptly stopping work can feel like a universal milestone. But when you start looking beyond your own borders, you quickly realize this is anything but universal. The concept of retirement is a fascinating tapestry woven from culture, economic realities, and government policy.

Getting this global perspective is incredibly freeing. It reminds us there isn't one "right" answer. This empowers us to define what the best retirement age for longevity means for our own lives, free from someone else's script.

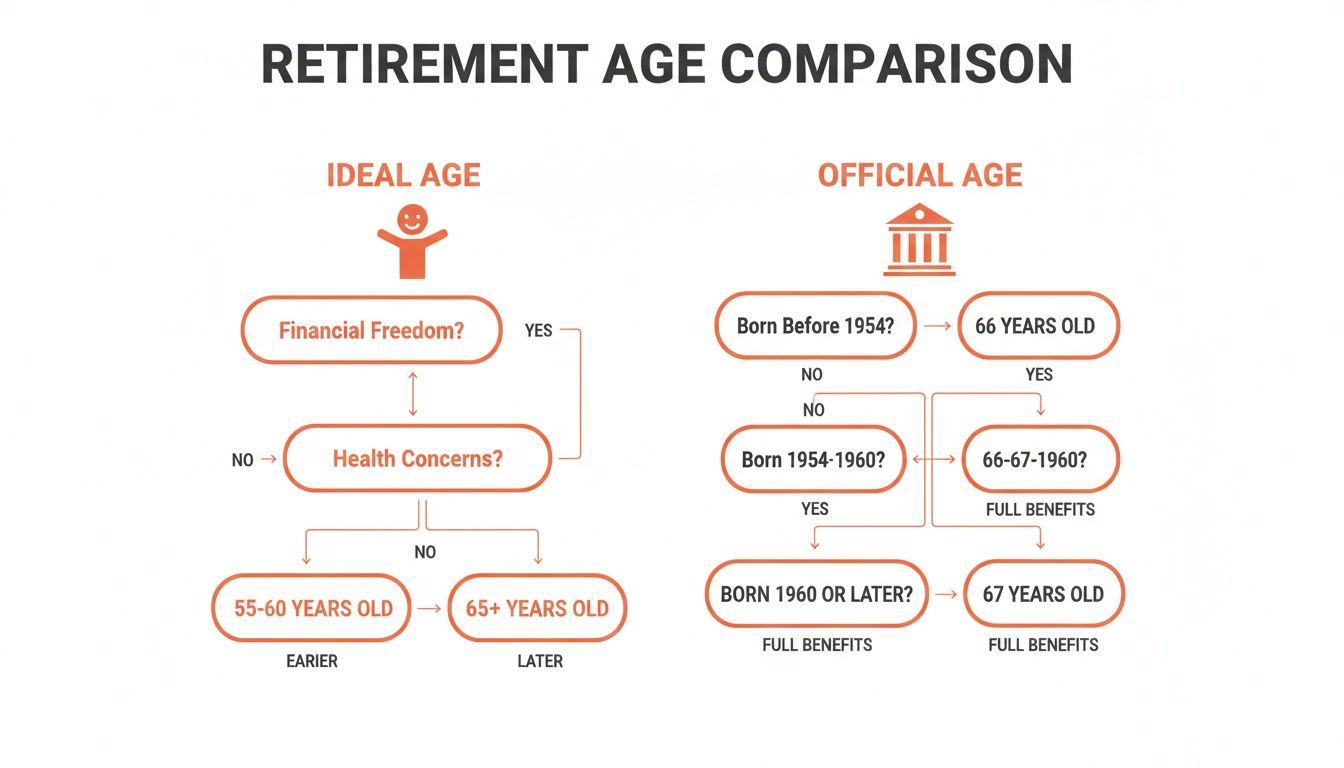

The Aspiration Gap: Ideal Versus Official Retirement

Look almost anywhere in the world, and you'll find a gap between when people want to retire and when they can actually afford to or are eligible for a state pension. This "aspiration gap" tells a powerful story about how people feel about work and aging.

Governments, on the other hand, are pushing official retirement ages higher to keep up with longer life expectancies. This creates a natural tension between personal desire and public policy. The ideal age is a personal preference, while the official age is often an economic necessity.

A really insightful global survey highlighted just how varied these ideals are. The best age to retire, according to public opinion, ranged from a youthful 52.1 in Colombia to 62.7 in Nigeria. Many countries landed somewhere in the late 50s. This often clashes with official pension ages; for example, people in Mexico hoped to retire around 57, a full eight years before their state pension kicks in at 65. You can dig into more of these fascinating global milestone preferences on pewresearch.org.

The table below really drives this point home, showing the disconnect between when people wish to retire and when government policy says they can.

Country | Average Ideal Retirement Age (Public Opinion) | Official Pension Eligibility Age (Approximate) |

|---|---|---|

Mexico | 57.0 | 65 |

Colombia | 52.1 | 62 (Men), 57 (Women) |

United States | 60.3 | 67 |

United Kingdom | 60.9 | 66 |

Japan | 61.8 | 65 |

Nigeria | 62.7 | 60-65 |

As you can see, in many places, policy and public sentiment are miles apart. This gap forces individuals to find their own solutions, whether that means saving more aggressively or rethinking what retirement looks like altogether.

How Different Cultures Approach the Transition

The very definition of retirement changes dramatically once you cross cultural lines. For some, it’s a hard stop. For others, it’s a much more gradual and fluid shift.

Phased Retirement: In places like Japan, the concept of a "cliff-edge" retirement is rare. It’s far more common for older workers to transition into part-time roles or take on new responsibilities.

Family-Centric Roles: In many collectivist cultures, retirement isn't an endpoint but a shift in responsibility. An older person might stop their formal job only to take on the vital new role of full-time caregiver for their grandchildren.

Encore Careers: In the U.S. and parts of Europe, the idea of an "encore career" is catching on. This is where someone retires from their primary profession to start a new venture, often one that's driven by passion.

Understanding these different models can open up a world of possibilities for your own transition. This kind of flexibility is a key ingredient in finding the best age to retire for your personal longevity.

Designing Your Personal Retirement Timeline

Let's move from the abstract studies to what really matters: your plan. Designing your retirement timeline isn't about plucking a random age out of the air. From my own experience planning for the future, I find it helpful to think of it as building a sturdy, three-legged stool. If any single leg is wobbly, the entire structure is compromised.

The goal is to define a retirement window—a period that supports a vibrant, healthy life on your own terms. This means taking an honest look at where you stand today across three core pillars: your financial health, your physical and mental wellbeing, and your sense of purpose. Answering these questions for yourself is how you find the best age to retire for longevity.

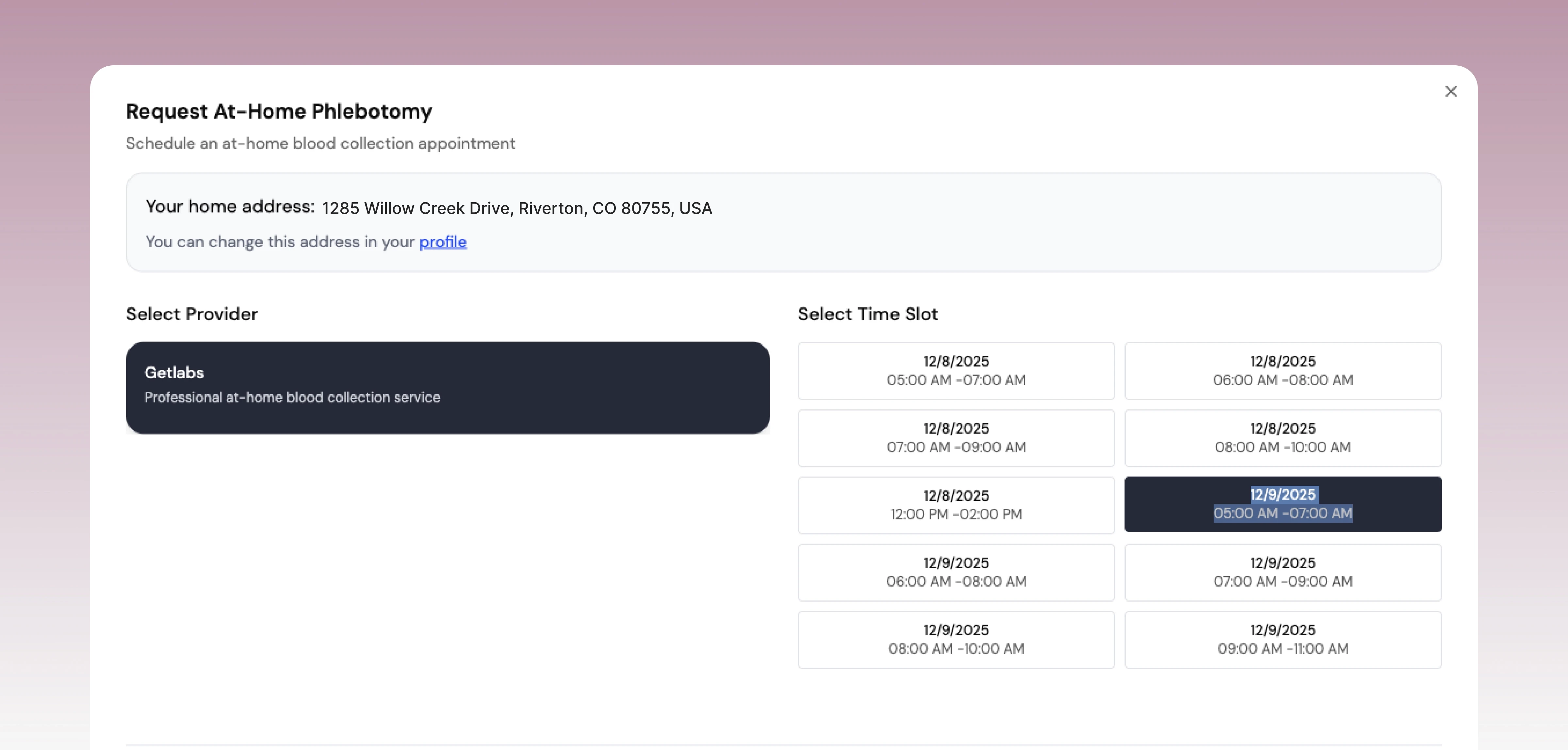

The chart below shows the classic disconnect between when people want to retire versus the official age set by policy.

As you can see, our personal aspirations often run ahead of the financial realities tied to things like government pensions. That gap is where your personal timeline becomes your most important tool.

Pillar 1: Your Financial Health

Being financially ready for a long retirement is about more than just having enough to cover the bills. It's about crafting a plan that can withstand the tests of time, like inflation and—most importantly—the soaring costs of healthcare.

When mapping out your timeline, you'll inevitably ask questions like whether early retirement at 55 is feasible.

Here are the kinds of questions to guide your thinking:

Healthcare Costs: Have I realistically budgeted for higher medical expenses, potential long-term care, and health insurance before Medicare kicks in?

Inflation-Proof Income: Does my plan include income streams that will grow over time? I need my purchasing power to hold up 20 to 30 years from now.

Longevity Buffer: Have I built a "longevity buffer" into my savings? Living into your 90s is no longer a long shot, so your plan needs to account for that.

Pillar 2: Your Physical and Mental Wellbeing

Your health today is the bedrock of a good retirement. This pillar demands an objective, data-driven look at both your body and your mind.

This is where personal biometrics become incredibly useful. Tracking key health markers can paint a clear picture of your biological age, which may be very different from your chronological one. Understanding these signals is a game-changer. You can learn more about which metrics to focus on by exploring the ideal blood test for longevity.

Consider these points:

Energy and Vitality: Do I actually have the physical energy right now to do the things I dream of for retirement? Or is my job slowly chipping away at my health reserves?

Cognitive Engagement: Is my work keeping my mind sharp and engaged, or has it devolved into a source of chronic stress? How will I stay mentally active after I leave?

Health Trajectory: Looking at my current lifestyle and health data, is my healthspan trending up or down?

Pillar 3: Your Purposeful Engagement

This is the pillar everyone forgets, but it might just be the most important for your long-term happiness and health. A career gives you a built-in structure, a social network, and a sense of identity. A smart retirement plan has to intentionally replace all three.

To build this pillar, start thinking about what genuinely drives you beyond your job title. What will give you a reason to get out of bed in the morning?

Social Connections: How will I maintain and grow my social circle without the day-to-day interactions of a workplace?

Daily Structure: What new routines will I create to give my days shape and meaning?

Fulfillment: What hobbies, volunteer work, or learning opportunities will I dive into to feel a sense of accomplishment?

By carefully evaluating these three pillars, you stop guessing and start planning. A clear picture of your personal retirement window begins to emerge—that sweet spot where your finances, health, and purpose all align.

Making a Smooth Transition into a Healthier Retirement

Quitting work cold turkey can be a huge shock to the system. From what I’ve seen, the people who really thrive in retirement don’t just jump off a cliff; they build themselves a gentle ramp. The healthiest transitions are almost always gradual, letting you ease into a new rhythm without losing the things that contribute to a long and healthy life.

This is all about finding a sustainable middle ground. These strategies help you dial back work-related stress while keeping the mental stimulation and social connections that are so crucial for finding the best age to retire for longevity.

Alternatives to the Cliff-Edge Retirement

Think of this transition period as a "deceleration lane" out of your full-time career. It gives you the space to adjust and build the framework for your new life before the old one disappears completely.

A few popular options include:

Phased Retirement: This just means slowly reducing your hours or responsibilities at your current job. It's a fantastic way to lower stress while maintaining some income.

Consulting or Freelancing: Putting your decades of expertise to work on your own terms can be incredibly rewarding. You control your schedule and workload.

Finding a "Bridge Job": This is a role, often part-time, that’s more about passion than a paycheck. Maybe it's working at a local library or for a non-profit you care about.

Building Your Pre-Retirement Roadmap

A successful transition starts months, or even years, before you clock out for the last time. The goal is to start weaving the fabric of your retirement life while you still have the structure of your career.

Leaving a high-stress job is a great first step, but it’s just as important to understand how to balance cortisol levels naturally to truly reap the health benefits.

Your Smooth Transition Checklist

Use these points to build a foundation for a retirement that actively promotes wellness right from the start.

Cultivate Your Hobbies: Don't wait until you're retired to figure out what you enjoy. Start dedicating real time to your passions now.

Strengthen Non-Work Relationships: Your work friends are great, but it's essential to nurture connections outside of that circle. Make a conscious effort to spend more time with family, neighbors, and friends.

Establish Healthy Routines: Begin building the daily habits you want in retirement now. This could mean starting a morning walk, setting aside time for reading, or cooking healthy meals.

A Few Common Questions

Deciding when to retire is a huge decision, and it's natural to have a lot of questions. I've spent years digging into the research on retirement, health, and what it truly means to live a long, fulfilling life. Here are some of the most common questions that pop up.

So, Does Working Longer Actually Make You Live Longer?

It's not that simple. The real link isn't about clocking in more years at the office; it's about the healthy habits and sense of purpose that a good job can provide. Think regular physical activity, daily mental challenges, and social connections.

These are the things that really move the needle on healthspan. If your job is a source of constant stress and burnout, sticking with it longer could do more harm than good. In that case, retiring earlier might be the healthiest move you can make.

What's the Single Biggest Mistake People Make When Planning for Retirement?

Hands down, it's focusing only on the money and completely forgetting about the social and psychological side of things. It's so easy to overlook just how much of our identity, daily routine, and social circle is wrapped up in our work.

How Do I Keep My Brain Sharp After I Stop Working?

The trick is to keep learning and challenging yourself with new things. Your brain thrives on novelty and complexity. You can't just do the same crossword puzzle every morning and expect to stay sharp.

Think of it like mental cross-training. Mix it up to build new connections in your brain:

Learn something new: Finally pick up that guitar or try learning Italian.

Play games that make you think: Chess, bridge, and other strategy games are fantastic.

Go back to school (casually): Sign up for a local class on a topic you've always been curious about.

Volunteer in a meaningful way: Look for a role that uses your problem-solving skills, not just your time.

At Outlive Biology, we're convinced that the best health decisions are based on your own data. Our platform is designed to help you make sense of your personal biometrics, translating the signals from your body into clear, practical guidance for a longer healthspan. By getting a handle on your sleep, stress, and metabolic health, you can map out a retirement that's not just financially secure, but also biologically tuned for a long, vibrant life. Learn how to take control of your health data today.

Live better for longer.

Research-backed tools, tactics, and techniques to maximize your health, delivered to your inbox every Monday.

Because real transformation starts with trust

and trust starts with clarity.

Founding Member Discount

Includes Devices + Labs

Cancel Anytime Before Activation